Bulgaria – Country Review

Quick Stats

Financial Outlook

- Bulgaria’s top 5 banks represented 56% of the sector’s total assets

- 70% of the banking sectors assets belong to foreign-owned banking groups

- Bulgarian National Bank introduced negative interest rates in Nov 2015

- In 2016, Bulgarian banks will be subject to the first ever Asset Quality Review (AQR), which will verify the stability of the Bulgarian banking system

Regularity Environment

- The country’s major financial regulatory authorities include the Bulgarian National Bank, the Financial Supervision Commission and the Bulgarian Deposit Insurance Fund

Insurance Environment

- The top five insurers (life and non-life) accounted for 50% of the sector’s total gross written premiums in 2014. Although these leaders incurred losses of over EUR 6 million, the sector as a whole reported positive results10

- Bulgaria’s non-life segment accounts for almost 80% of all insurance premiums underwritten by the industry11.

- The motor vehicle line accounts for approximately 68% of all non-life premiums

- Implementation of the Solvency II Directive is set to be a significant challenge for the Bulgarian insurance sector.

- Growth in the non-life segment will be constrained by slow macro-economic growth

- An increasing number of mergers and acquisitions is expected to take place among Bulgarian insurers

Asset management and capital markets Outlook

- Foreign-owned investment funds controlled 59% of the total assets managed in 2014

- The value of the sector’s total net assets grew by 64% between 2012 and 2015

- The stock exchange is divided into two separate listings, according to the size of the listed company: the more regulated market (the Bulgarian Stock Exchange) is for established firms, and the Bulgarian Alternative Stock Exchange lists less liquid companies.

- In January 2016 on both stock exchanges there were 372 listed companies.

SWAT Analysis

Strengths

- Bulgaria has one of the lowest government debts in the EU (at around 30% of GDP in 2015).

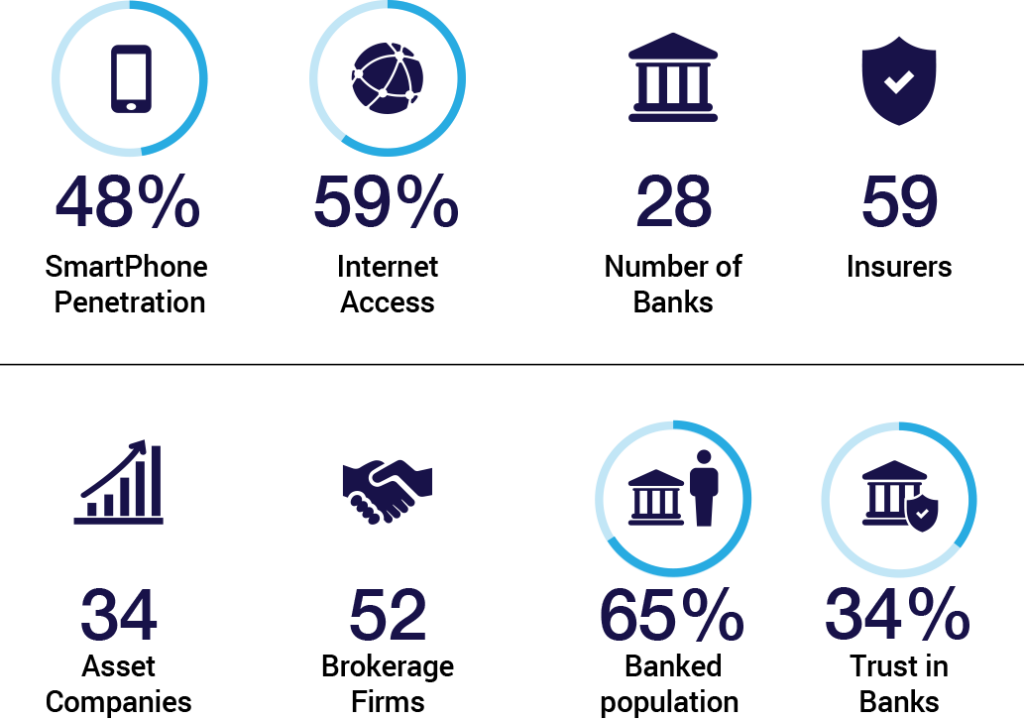

- Internet penetration is 59% and smartphone 48% phone.

- Bulgaria has the lowest total labour cost in the EU-28 (84% lower than the average).

- The IT sector is forecast to yield some 2% of the country’s GDP in 2015, after 4 consecutive years of double-digit growth.

Weaknesses

- The domestic market is relatively small with 7.1 million inhabitants.

- The non-observed economy in Bulgaria constitutes over 30% of GDP, the worst in the EU.

- Among CEE countries, Bulgaria has the lowest ratio of GDP per capita (EUR 12.800 vs the EU average of EUR 20.441) and of gross disposable income per capita (EUR 8.921 vs EUR 14.533).

- The unemployment rate grew by 7.4 percentage points between 2008 and 2013 (from 5.6% to 13.0%).

- Bulgaria has one of the lowest ratios of internet users (as a percentage of 16-74 year-olds) compared to the CEE average (55% vs 68%).

Opportunities

- Real GDP increased by 2.2% in 2015. Although this rate of increase is expected to slow down in 2016 to 1.5% (due a decrease in EU-funded investments), GDP is expected to pick up again to 2.0% in 2017.

- In 2014 there was a reversal in the trend for growing unemployment. The rate decreased to 11.4% and is expected to fall further to 8.8% in 2017.

- Bulgaria’s corporate income tax (CIT) rate is the lowest in the EU at 10%. The personal income tax rate is at, also at 10%. Industries that face structural unemployment issues are granted a 0% tax rate.

Threats

- The working-age population is estimated to be set to decrease by 41% between 2013 and 2060.

- Only 9% of Bulgarian enterprises use e-invoices, as compared to 12% in CEE, and only 4% use cloud technologies (against the CEE average of 8%).

- Bulgaria has one of the lowest proportions of banked citizens in the CEE region – 63%, 16 percentage points lower than average for CEE countries.

- Bulgarians have one of the lowest trust in banks ratios in the CEE region at just 34%.

- As many banks operating in Bulgaria are Greek-owned (with a market share around 20% in 2015), their potential divestment may pose supervisory challenges and result in substantial changes to the structure of the banking sector.

+381 11 33 44 147

+381 11 33 44 147